How To Pay Off Your Mortgage

How to easily pay off your 500k mortgage in 10 years. Can you do it? If you own a house and already paid off your mortgage, then congratulations to you. If you still need to pay off your mortgage or are looking for a suitable house to buy, then this article may help you save up on your mortgage repayments.

1. Let Us Talk, Mortgage Payments.

A typical mortgage lasts for 25 to 30 years. The payments generally spread up over the lifetime of the mortgage and they divide each monthly payment into principal and interest. Mortgage payments are front-loaded so at the beginning of the mortgage term, your repayments will comprise mostly of interest. Toward the end of the mortgage term, the repayments comprise mostly of the principal portion. They do this so that the lenders can recover their interest first. Let us look at a worked example to show this more clearly.

This shows that if you took out a mortgage off $200,000 for 4 years, then you would end up paying $4322 interest on it and you can see that this loan is front-loaded. As time goes on the interest payments reduce.

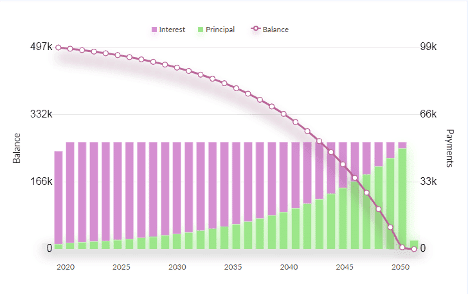

Now, this was a simple, worked example. When we talk about mortgages, we typically look at 30 year outlays with monthly payments. Let us assume that your house costs $600,000, and you have paid $100,000 upfront and you now have $500,000 to pay in mortgage over 30 years. In this situation, your monthly payments will be around $4388 each month for 30 years. The repayment schedule for this would be too long to show here so we will instead look at the graphical presentation. It shows the repayment to understand how interest and principal payout work over the lease term.

We can see from the graph that this is also a front-loaded mortgage, as time passes the interest payments reduce and principal payments increase. As we have mentioned before, this is how lenders secure their interest payments.

Now, suppose you wanted to pay your mortgage in 10 years instead of 30. Would that be a good idea? Yes, and No.

Yes, because by doing so you will pay off your mortgage in one decade instead of three and this will allow you to save money and use it for other purposes. It will save your time and free up your savings. This will also pay off your debt much quicker and you will own your house within a decade. Besides this, you also incur lesser interest if you pay your lease in 10 years instead of 30. We will look at this in greater detail in a while.

Read More: https://www.australiaunwrapped.com/benefits-of-paying-off-your-mortgage-early/

2. What Complexities exist?

There are a few complexities that we need to consider first. If the original mortgage term is 30 years, then paying it off early may not be such a good idea because mortgages usually contain an early payment penalty. It discourages the borrowers from paying early.

This early payment penalty exists because, at the time of drawing up the mortgage, the banks or lenders work out the time of the value of money. The longer you borrow the money, the higher interest you will have to pay. So if you sign the mortgage for 30 years and then change your mind and pay it back in 10, the lender will be at a loss and for this, the lender will charge you an early payment penalty.

You can avoid this in two ways. You can either take your time to think it through before you sign the mortgage or you can sign it for 10 years instead of 30. In this manner, they subject you to the interest rate for 10 years. Thus you will not have to go through any early payment penalty. Or if you have already signed a 30-year mortgage, you can contact your lender and renegotiate your mortgage term. Likely, the lender may still charge penalties or fees to convert the lease term to 10 years. The penalty may not be as much as the extra interest payments that you will have to make on a 30-year mortgage.

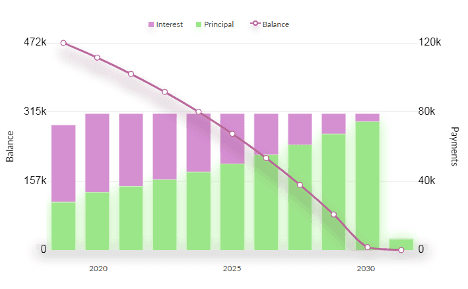

Let us now look at a 10-year mortgage.

Everything is the same in this case except for the mortgage term. In the previous example, the mortgage displayed 30 years ending in 2050 and in this one the mortgage is for 10 years ending in 2030. It is evident from the graphical presentation that the interest payments are lower.

| Term | 10 years | 30 years |

| Mortgage Amount (Principal) | 500,000 | 500,000 |

| Interest Payment | 292,904 | 1,079,629 |

| Total Amount Paid | 792,904 | 1,579,629 |

| Monthly Payment | 6,607 | 4,388 |

The table shown above sheds more light on the difference between 10 years and a 30-year mortgage. As I can see that for choosing between the two options, the 10-year mortgage makes more sense because its total payments are almost 50% lower than compared to the 30-year mortgage. Let that sink in. A 10-year mortgage costs 50% less than compared to a 30-year mortgage, but its monthly payments are 50% higher than those of a 30-year mortgage.

So here is the catch. If you cannot afford the high monthly payments, then you will have to settle in for the 30-year mortgage where you will end up paying a lot more. Whereas if you can afford the high monthly payments then going for the 10-year mortgage is the obvious choice.

Read More: https://www.australiaunwrapped.com/financial-technology-set-to-revolutionize-the-banking-sector/

3. Do I Need To Make Lifestyle Changes?

You may have to make some lifestyle changes if you go for the 10-year mortgage. You will need to cut down your expenditures and your savings rate to make room for the high monthly payments. Some of us need to smart plan our business thinking, for example, selling a construction company. For ten years, that is a whole decade, manage your finances in a much disciplined manner. This will require some smart budgeting and money-saving hacks to make sure you pay off your debt as quickly as possible without running into financial troubles.

Conclusion

How to easily pay off your 500k mortgage in 10 years. Do not feel apprehensive though, this is not impossible. Many people choose this option and end up getting rid of their mortgage in ten years with careful personal financial management. All it requires is a proper financial strategy that needs a follow-through.

Also, Enjoy: https://www.australiaunwrapped.com/australian-property-market-in-2015-how-has-it-gone-is-the-mad-rush-over/

Also See: Labour Crisis: Who is The Possible Jeremy Corbyn Challenger?