Why Bitcoin is Better Than Stocks?

Why is BitCoin Outperforming Stocks? They launched BitCoin in 2009 when the 2009 financial crisis was levelling out.

Disclosure this article contains sponsored content.

Launched by the mysterious Satoshi Nakamoto on the blockchain platform, BitCoin caused quite a stir in the financial markets. In almost a decade since they launched BitCoin hundreds of cryptocurrencies displayed varying degrees of success. But BitCoin remained the currency many people identify blockchain with.

1. Volatility Reasons

Over the years BitCoin experienced a lot of volatility, especially in 2017 when the value of BitCoin reached its highest point. Although its value fell after reaching the peak, this made many investors and speculators think it was the end of BitCoin. But since then, BitCoin showed resilience and regained some of its value.

The current crisis pushed the global economy into a recession and IMF voiced concerns that the coming global recession may be worse than the Great Depression. Since January, oil prices became volatile and the recent price wars saw the oil prices tumbling down. This happened with the oil prices, energy stocks also fell through the floor. Every stock market went into free fall for weeks and it triggered multiple circuit breakers every day.

Why is BitCoin Outperforming Stocks? Investors lost billions of dollars in a matter of a few days as the markets crashed. BitCoin also crashed at first because fears of a recession caused many investors to panic and look for safe havens for their investments. Let us remember that this is the first time that BitCoin is facing a recession. It became launched in 2009 when the large part of the recession was over and the last ten years have been fairly stable.

We can consider this as the first endurance test for BitCoin and cryptocurrencies. So like all other investment options, BitCoin lost its value at first as speculative investors dumped their investments. This is to look for safe havens such as gold.

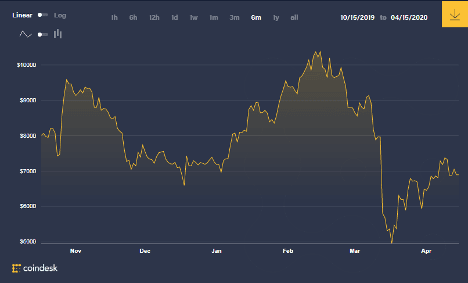

The big cliff shown by the fall in the price coincides with the stock market crash in the American, European and Asian markets. The cliff shows 2 drops separated by half a day. The price of BitCoins fell from $8000 to $6000 and then it fell to $3800 before starting the recovery. These two drops accounted for almost a 51% loss in the value of BitCoins within 24 hours.

Read More: Bitcoin Prices, are we in a Bubble

2. Bitcoin Recovery

However, it can be seen that following the drop in value, BitCoin recovered its value to almost around $7000. This shows that investor confidence is returning after a brief shock. But what is more important to note here is the stability in the value of BitCoin over January and February. China went into lockdown and the markets saw first signs of decline, BitCoin, however, remained fairly stable during this time. The sharp peaks may look like BitCoin has not been stable, but these peaks are a part of the inherent day-to-day volatility of BitCoin. These peaks matter little when you look at chunks or segments of time.

It is important to note that BitCoins remained fairly stable and only when every market crashed, did BitCoins show a similar crash. But recovered fairly quickly too. Why?

It exposes the reason BitCoin could recover quickly and hides in the very nature of Bitcoins. Also, the realisation among the investors is that BitCoins are not susceptible to some risks that stocks normally experience.

It limits BitCoins in supply at 21 million BTC, whereas the supply of money in the economy is not finite. The stimulus packages announced by the US government prove that the Fed can print and pump money into the economy. This adds to the uncertainty.

Investors who seek “real” value for their investments realise that BitCoins are limited in supply. This makes them rare, and therefore valuable as the classic definition of the currency goes.

Money is not rare if the Fed can pump trillions into the economy to provide much-needed liquidity. It simply means that the system is too weak. The circular flow model is not working efficiently, which is why trillions have to be injected into the system to keep it afloat.

Another reason for the rebound and strong performance of BitCoin as compared to other stocks is its inherent nature. Investors are now questioning the stability of the financial system. The stock markets triggered multiple circuit breakers over the last few weeks to prevent panic selling among the investors. The market recovered after news of OPEC agreeing over an oil price. But the Covid19 pandemic is still developing, and it sends another shock to the stock markets. If the circuit breakers fail to prevent the panic, then the market may have to be closed to prevent a debacle.

Bitcoins, on the other hand, cannot be controlled or shut down by any government. This is since they are on a decentralised platform and not regulated by any government. Even if the financial market crashes, BitCoin will be there. In this regard, BitCoins are kind of like gold as a haven for investment.

Read More: How to buy BitCoin Online

Conclusion

Why is BitCoin outperforming stocks? As the financial crisis worsens and markets go through another shock, investors may very well buy Bitcoins. This is to hedge their investments. The volatility in the value of Bitcoins, however, will put off some investors. Nevertheless, as more investors turn to Bitcoins, the increased demand for BTC. It will drive the value up as it is doing now.

Also Enjoy: Global Financial Crisis

Disclaimer

Australia Unwrapped provides only general and not personalised financial advice and in no way has taken your circumstances into account. Investments go up and down; any questions, talk to a financial advisor. This blog is opinion only, and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or

the authenticity of postings, comments or the article.

Also See: Indexed and Associative Arrays in PHP

What Caused the Great Depression and Can We See Similarities Today?

Fun Fact

Is Bitcoin stock a good investment?

Digital currencies can also be viewed as a long-term investment because of their high demand. Because bitcoin has such a high liquidity, it is an ideal vessel for short-term profit.