5 Reliable Australian Cannabis Stocks For You To Buy

In the last article we covered the top 5 Cannabis stocks in the ASX. This article is a continuation of the last one and in this one we shall look at more companies that should be under the radar of long term investors looking to profit from cannabis stocks. The caveats mentioned in the previous article apply to this one too.

This is a very young industry with even younger companies. Profitability therefore is expected to be very low at the moment. It will take at least 3-5 years for profitability to rise, as it will take time to create the required infrastructure and markets.

Let us now look at 5 more Cannabis stocks that should be on the radar for long term investors.

1. MGC Pharmaceuticals (ASX:MXC)

MGC pharmaceuticals is an Australia based medical cannabis company that is focused on the production of phytocannabinoid-based medicine for the biopharmaceutical sector. MGC pharma plans to expand its product offering globally to regions such as Europe, North America and Australasia.

MGC currently has got 3 main products namely

- CannEpil: Oral treatment for seizures occurring due to epilepsy.

- CogniCann: Oral spray consisting of the psychoactive THC to deal with dementia.

- InCann: Oral solution for Crohn’s disease and colitis.

The company has got a market capitalisation of AUD 63 million roughly and the share price is roughly AUD 0.023. Although the year 2020 has in general been turbulent for business, it can be seen that the share price of MGC has stabilized since May. All of the financial fundamentals are generally in the stable zone. However the liquidity ratios are slightly in the dangerous zone. The current and quick ratio are good but any external shock can knock these good liquidity ratios into the danger zone if the company is not careful with their financial management.

Once again, it must be remembered that the medicinal cannabis sector is a very young sector. It is in its nascent state and therefore one must not expect these companies to perform at a level similar to Amazon, Google and Tesla. This is a very young industry on its own and the companies in this sector are not just young but they have invested a lot into research and development, which is still ongoing.

Investors investing into this sector must be aware that these companies are not very profitable right now as most of the companies do not even have completely finalized products. The period for profitability is at least 3-5 years from now, when the investors can expect to make some profits off these investments.

Also See: Australia-China Trade: How Important Is It?

2. Botanix Pharmaceuticals (ASX:BOT)

Botanix pharmaceuticals is a company that is interested in exploring the unique properties of synthetic cannabinoids. The company is therefore developing a drug delivery system that can deliver the drug through the skin. The system has been termed Permetrex, which is going through the clinical trial stage.

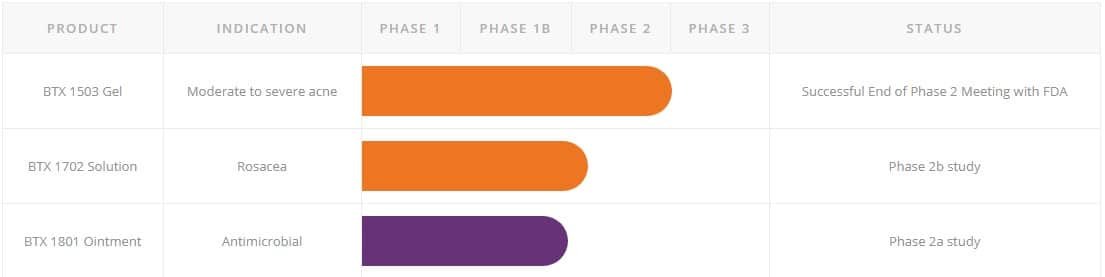

At present Botanix pharmaceuticals does not have any finalized product that can be offered to the general public. Botanix has got three different products that are in different phases of completion as shown below.

It can be seen that Botanix is developing three different products that will be based on gel, solution and ointment mediums. The products being developed can be used to treat acne, psoriasis and atopic dermatitis.

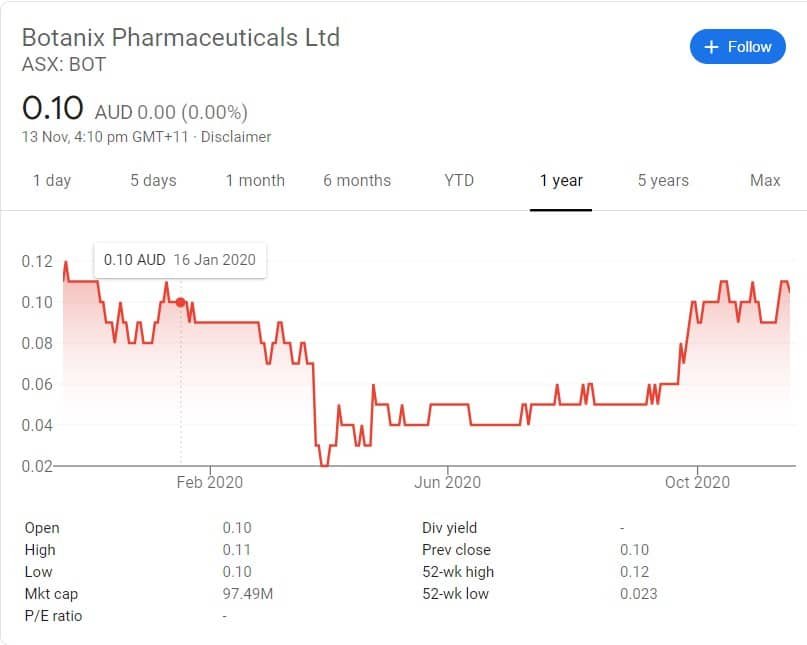

The company has got market capitalisation of almost AUD 76.5 million. The share price performance is shown below.

The current share price of Botanix is AUD 0.096 and this share price has increased in the last month. The share price movement shows cyclic movement between July to November each year roughly. If we remove the effect of the 2020 March crash, then it would appear that the share price of Botanix would have done actually better than what it did last year, the mean reversion trend for Botanix is clearly on an upward slope, however the March 2020 crash knocked it off a bit. It appears that the share prices are recovering as the annual cyclic activity is picking up.

This company is an ideal target for growth investors. The company does not have any product offering as of yet therefore it is not generating any money through commercial sales. As the products are completed and rolled out, one should expect the share price to increase.

3. Medlab Clinical (ASX:MDC)

Market cap: AU$82.30 million

Medlab is a medical research and development company, unlike the other companies we have mentioned so far, Medlad is not entire focused on Cannabis based medicinal products. It therefore has got a portfolio of non cannabis based products that are already in the market.

Its research on cannabis based medicinal products is ongoing. The company has got two cannabis based products namely

- NanaBis: Adjuvant and/or replacement therapy to opioids in advanced cancer pain

- NanaBidial: CINV and Seizures

Both of these cannabis based medicines are at their clinical trial stages and expected to be available for general public by mid 2021.

The company has got market capitalisation of AUD 82.3 million and the share price is hovering around AUD 0.185. Some investors may find it safer to invest in Medlab because they have got a more balanced portfolio, consisting of medicines that are based on different source ingredients and not just cannabis.

The share price movement has shown that the share prices have dropped by 50% since November 2019 but this is a common story with every pharmaceutical company because of the market conditions created by Covid.

Also See: 10 Most Successful Entrepreneurs Under 30 In the World

4. Cann Group (ASX:CAN)

Cann group was established in 2014 in Australia with the vision of researching and developing cannabis based products. It was the first company in Australia to obtain Cannabis Research and Cultivation Licences by the authorities in Australia. Cann group has a collaboration network in place with the leading Australian medical scientists, who carry out research to discover, analyse and use the medicinal properties of cannabis. Their research is focused upon the different bio active ingredients present in cannabis such as cannabinoid and terpene.

The market share of the Cann group is almost AUD 285 million and their share price is approximately AUD 0.14. The share price as it can be seen has stabilised since August. At present the share price is almost half of what it was at the same time last year. This shows that the Covid-19 pandemic has knocked off almost half of the value from the share price of not just Cann group but also other companies in the sector.

The revenue position of Cann group has also fallen significantly in 2020 as compared to 2019. The revenue in 2019 was almost AUD 2.3 million but in 2020 this can be reduced to AUD 0.6 million. This shows a reduction of almost 73%. Other income has also fallen from AUD 1.9 million to AUD 1.2 million approximately.

The liquidity and profitability both look poor. The company was already operating in loss but now it is also becoming illiquid because cash reserves have fallen quickly. However for a company that began operating fully around 2014, it is still too early to show full steam. Furthermore the medicinal cannabis industry is still in its nascent state as well and any positive growth that could have been achieved in 2020 has been marred due to the Covid-19 pandemic.

5. AusCann Group Holdings (ASX:AC8)

Market cap: AU$330.23 million

The objective of AusCann is to provide high quality cannabinoid medicines. Their first product was launched in April 2020, this product targets patients suffering from chronic pain. The medicine has both THC and CBD in a one to one ratio. The medicine is a dry powder based medicine that is delivered through a hard shell based capsule.

Generally cannabis based medicines are based in oil, tinctures or spray form. The medicine prepared by AusCann is a powder based medicine encapsulated in a tablet, which the doctors have found better in terms of its profile.

AusCann group has got market capitalisation of approximately AUD 330 million and their share price is hovering around AUD 0.14. As it can be seen, the year 20202 has been particularly bad for AusCann group, inspite of the fact that they launched a product earlier this year. Although the Covid-19 lockdowns knocked off more than half of the share value but as it can be seen that the share price was already on a downwards trend even before the pandemic struck.

The total revenue generated in 2020 is AUD 3.2 million. The gross profit for the year was almost AUD 1 million. This makes the gross profit margin to be approximately 31%, which is fair for a company that has just launched its first product. The total income for the company is around AUD 1.7 million, this figure includes both the sales revenue and revenue earned through interest and other sources.

The financial fundamentals of AusCann group are looking good at the moment but investors need to consider a few factors before investing. The financial position of AusCann group displays the typical financial position that young companies have in the nascent medicinal cannabis industry. This is a young industry with even younger companies.

The supply chain network is being set up, infact even the products are in their early research and development phase and therefore for an industry with these factors it is common to have companies with carried forward losses and high leverage.

Companies like the AusCann group are ideal for long term investors who can hold their investment with patience. This sector is expected to go through growth and boom phases in the coming few years and therefore long term investors are investing in such companies, without being too worried about the year on year losses and lack of dividends. Logically however this sort of situation is not suitable for short term investors looking to make gains from daily price movements, as these companies have not much to offer to the short term investors.

Main Image Source : Pixabay

Also See: How To Manage Your Budget When Losing Your Job

The Hidden Cost Of Printing Money And Why Quantitative Easing Is A Road to Ruin