Investing in MGC Pharmaceuticals Ltd, A Big Yes or No?

MGC pharmaceuticals is a Europe based bio-health company that is focused on using the latest technology and innovative methods to look into new ways of developing cannabis-based medicinal products. The company is at present operational in Australia, Slovenia, Israel and India and the company is looking to expand into UK markets as well. The company aims to develop high-quality photo cannabinoid driven medicines and supply them to the global market.

Ongoing Research

The company is collaborating with different institutes and universities to research and develop new cannabis based medicines and delivery mechanisms. Three key areas in which their research is focused right now are

- Neurology

- Epilepsy

- Dementia

- Cerebral Palsy

- Oncology

- Cachexia

- Pain

- Cancer

- Autoimmune

- Anti inflammatory

- Anti bacterial

The company is collaborating with the Royal Melbourne Institute of Technology (RMIT). MGC has funded the research into the following areas

- Cancer

- Nanotechnology based delivery systems

- Combination of traditional medicines and cannabinoid therapies

MGC has also collaborated with the National Institute of Biology in Slovenia. This collaboration was done to carry out research into the efficacy of cannabinoid driven medicines.The data gathered as a result of this collaboration, has recently been published for experts to analyse.

MGC is also partnering an ongoing research with the University of Ljubljana. In this project, MGC grew, flowered and harvested the genotypes, which are now undergoing EU registration.

Also See: 5 Signs a Company May Be Heading Towards Bankruptcy

Product Trials

MGC is currently carrying out the clinical trials of the following products

- CannEpil: This trial is taking place in Israel, for a cannabis based medicine that can be used for children and adolescents suffering from refractory epilepsy.

- CogniCann: This trial is taking place in Perth, to find out the effect of CogniCann on patients with Alzheimers and dementia.

- Artemic: This trial is taking place in Israel. It is being tested for its efficacy for viral infections and is currently being tested for Covid-19 patients.

Apart from these three products, MGC has got 7 other products that are in their pre clinical phase.

MGC is also carrying out research into a nanotechnology based drug delivery system that can enhance the efficacy of medicines.

Financials

The financials of MGC pharma show a picture similar to other loss making companies in the bio health sector. If you have read reviews of other companies, then most of what we are going to write now will seem familiar but there is a little twist in the end.

MGC showed positive sales revenue growth in 2020 but like many other companies in this sector, MGC is registering a net loss since the last few years. This net loss is because of the expenditures being incurred on the research and development of new medicines and delivery system. It is therefore totally understandable why the company is making a loss.

What is different for MGC however, is that it is ahead of other companies in this sector in terms of research. As we have read above, three of its products are already in the clinical trial phase. This means that the investors are seeing that the sales revenue that is being injected into the R&D, is bearing fruits.

In addition to this let us not forget that many companies in this sector have poor sales revenue, MGC at least has managed to keep its sales revenue positive, which for the investors is a good sign. This shows that the company has a ready market and if new products are approved and rolled out, this market is only going to increase further.

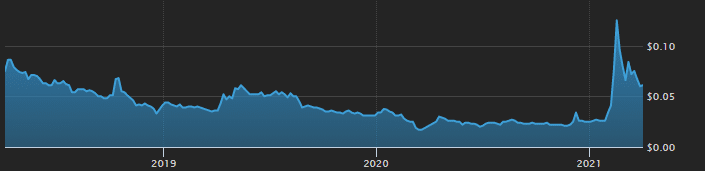

It is perhaps because of this that the price of MGC shares has gone up in the last quarter, after the results of 2020 were released.

This graph shows that following the announcement of the results for 2020, the share price for MGC shot up. In the short term the price has gone up by over 450% and in the long term the price has gone up by almost 25% in three years.

Also See: How to Save For Hard Times and Manage Your Finances In Covid 19

This means that out of all the companies in the medicinal cannabis sector, MGC has the best performing share price. Its financial performance may be very similar to the other companies but the fact that it has got products so close to being rolled out is deriving the share price upwards.

For the short term investor, the last four to five months have been very good. The share price appreciation hsa created good returns for investors who were holding on to their stocks. The long term investors too have seen their wealth increase.

If the company continues to perform and rolls out its products soon, we can possibly see another share price hike. For this however the company will also need to focus on its liquidity. The cash flow position is in the negative, which can be attributed to high investing and financing activities. The quick ratio is less than 1 which is a very troubling sign for long term investors who look at the financials before investing.

Overall, MGC looks like a good investment opportunity. The current share value price hike seems to be coming to an end but investors should look out for another price hike later this year, particularly close to the dates of quarterly results.

Disclaimer

Australia Unwrapped provides only general, and not personalised financial advice, and in no way has taken your personal circumstances into account. Investments go up and down, any questions talk to a financial advisor. This blog is opinion only and in no way should investment decisions be based on this information.

Australia Unwrapped does not endorse or vouch for the accuracy or the authenticity of postings, comments or the article

Main Image Source: Pixabay

Also See: Highest Paying Dividend ASX Shares for 2021

What a Diverse Portfolio! How Many Companies Should I Buy Into?